Primer on Trust Accounts Dont Use Money & Do Keep Records

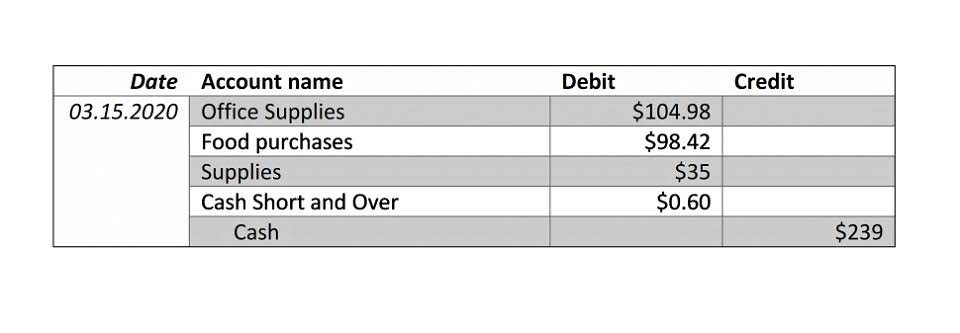

If you have a line of credit that hasn’t been drawn upon, it should be counted as an asset (you could consider it cash on hand). Once withdrawn, the line of credit would no longer be counted as fixed assets an asset—it would become a liability (as it is then money owed). The items are automatically added to a customer invoice at billing time. Now that we have the basic financial concepts down, there’s one more point worth hitting now before we dig into details. Ultimately, you want your business to have access to as much cash as possible.

Understanding Your Law Firm’s Financial Levers

By addressing these requirements from the outset, your chart of accounts becomes a powerful tool for financial management and decision-making. This structure enables the firm to generate accurate financial statements, including balance sheets, income statements, and cash flow statements, with ease and precision. By categorizing transactions in a consistent manner, a well-structured chart of accounts enhances the firm’s ability to track income and expenses.

Setting Up A Legal Chart Of Accounts For Your Firm

Some investors also prefer accrual accounting since it more accurately records income and expenses when they were earned. In the intricate world of law firm finances, a robust accounting system is the linchpin for success. Accounting is not just about tracking numbers; it’s a strategic tool that ensures regulatory compliance, expense precision, and overall financial prosperity. One crucial component in this financial toolkit is the Chart of Accounts.

- Reimbursed Client Costs are expenses to be billed to a client but that are paid from the Firm Operating Bank Account.

- Within each category, you can further organize accounts by subcategory.

- These funds are then used for charitable causes, such as access to justice services.

- We respect our clients enough to make them full partners in the legal process, keeping them informed and inviting their participation every step of the way.

- The firm could face compliance issues, and their books will be inaccurate (skewing the value of any accounting data derived from them).

Clio Accounting: Accounting made approachable

Chart of Accounts SampleA sample chart of accounts generally shouldn’t be copied directly into your law firm accounting software without some customization. Law firms typically keep both client account records and https://www.bookstime.com/ firm account records. Client account records track the money the firm handles on behalf of its clients. Firm account records, however, track the firm’s own financial transactions and expenses (such as salaries, rent, and utilities).

- Your firm’s various financial accounts are organized under these categories.

- If you want to track additional information regarding the Matter, you can set up Custom Fields on this screen and fill them in here.

- Be certain that your bank gets this set up as an Interest on Lawyer’s Trust Account so the interest will be handled properly.

- Every law firm operates differently, with distinct practice areas and billing methods.

- Managing a law firm chart of accounts and general ledgers involves numerous transactions, strict regulatory requirements, detailed reconciliation needs, and accurate financial reporting.

- Using technology—such as QuickBooks Online and Clio Manage together—also make this process easier and more efficient.

When done correctly and consistently, legal accounting can help law firms better manage expenses and costs and identify opportunities for increasing revenue. Proper accounting records can also help lawyers make informed, data-driven decisions for their firms and can aid in financial planning for greater long-term success. Having a law firm chart of accounts is more than just an accounting best practice— it’s a tool to keep your firm’s financial data organized. Also, many firms don’t realize how many accounts they must track to accurately reflect the firm’s value. When set up correctly, a law firm chart of accounts provides an accurate picture of your law firm’s financial situation now, and as you move forward. Accurate accounting helps law firms ensure they remain compliant with all laws and requirements, maintain accurate records to inform business decisions, and provide transparency with clients about their funds.

Interest earned on IOLTA accounts is sent directly to local Bar Associations to support charitable legal services. Regardless if you’re directly managing your firm’s accounting, it’s important to familiarize yourself with basic accounting terms and principles. A baseline understanding can make it easier to review reports and comprehend recommendations from your accounting team. Your statement of cash flows (or cash flow statement) shows you where your cash comes from and where it goes in a month. As the owner, you need to know if you have enough cash in the bank to fund operations each month. Cash flow issues pop up for many businesses, no matter the size–one bad collection month or an unexpected bill can significantly impact your cash position.

- Accounting for lawyers refers to the range of accounting practices that lawyers and law firms take on to meet the financial, regulatory, and tax requirements that come with the practice of law and running a legal practice.

- This customization ensures accurate financial reports that provide meaningful insights into managing a firm’s finances effectively.

- Also, it facilitates monitoring of cash flow and identifies financial trends or anomalies.

- Plus, falling behind on tracking expenses can impact the earning potential of a law firm when you consider how some jurisdictions calculate the payout after expenses or liens have been deducted.

- This means that, in addition to using legal accounting to stay compliant, legal professionals can use proper law firm accounting to help maximize profitability and growth.

What is a Law Firm Chart of Accounts?

For example, you may appear to have more cash than you have if outstanding payments are owed to vendors. This is a contributing factor of why the general accounting principles (GAAP) does not find cash accounting acceptable. It can also be complicated to switch from cash accounting to accrual accounting. Cash accounting, or cash basis accounting, is when a firm reports transactions only when cash is received or paid out. This is the simpler method of the two and is commonly used by small businesses. By comparing this year’s current assets minus liabilities with last year’s, you can see the trajectory of your firm’s annual growth and expenses.

As a lawyer, you know that setting up a legal chart of accounts is essential for managing your law firm’s finances. The legal accounting process can be complicated, but law firm chart of accounts a well-organized chart of accounts can help you keep track of your finances. Moreover, it ensures compliance with the Lawyer Trust Account (IOLTA) and other legal accounting regulations. LawPay and MyCase, together, streamline the processes for tracking time and expenses, invoicing, and collecting client payments.

![]()

Step 8: Implement Multiple Payment Methods

These components establish a structured framework for managing financial data, aiding law firms in managing resources and making informed decisions. Lawyers are permitted to maintain their trust accounts only at those New York banks which agree to provide bounced check reports to the Lawyers Fund for Client Protection. Most investigations based upon bounced check reports are closed with no finding of wrongdoing by the lawyer or law firm and no discipline imposed.